The Inflation Rate in Pakistan

Pakistan is facing an unprecedented escalation of its inflation rate. In response to the rising borrowing costs, the State Bank of Pakistan has raised interest rates for the Pakistani economy, eroding investor confidence. As a result, the inflation rate in Pakistan has surpassed the double-digit mark, marking the most significant increase in six years. It has exacerbated Pakistan's already poor economic and social conditions, which have been plagued by theft, smuggling, violence, and other social and economic problems.

Inflation

Rate from 1970 to 2022

Inflation rates have increased in Pakistan in recent years. In the first half of 2018, the country experienced an inflation rate of 3.93 percent. It sharply increased from the previous year's rate of 3.91 percent. Pakistan is one of the largest Muslim countries in the world, but the country has very low urbanization, with most people living in rural areas. The country's economy is based on the service sector, which employs most of the workforce. As a result, economic growth is relatively stable in Pakistan.

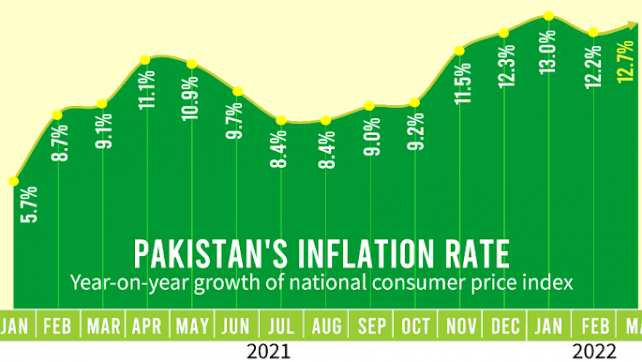

Inflation rates are measured using the consumer price index (CPI). The CPI is a gauge of the average consumer's cost of goods and services. The index can be fixed or adjusted annually to reflect price changes. Typically, the index is calculated by using the Laspeyres formula.

A moderate level of inflation is healthy for the economy. Inflation can be very destructive if it's too high. A country's financial regulator needs to keep the rate moderate but not excessive. Inflation is how new money enters the economy and circulates within it.

While various factors cause price increases, one of the most common causes is the speculative boom in oil prices. That increases the cost of oil and other vital commodities. Higher prices lead to lower purchasing power for the average consumer.

Pakistan

Economy Slows Down While Inflation

According to Bruno and Easterly, Pakistan's economic growth and inflation rate have a negative relationship in the short run. However, the relationship is not permanent, and the sign of the relationship depends on the inflation rate. Low inflation favors economic growth and encourages high productivity and output levels. In Pakistan, several factors affect economic growth, but three of the most critical factors are an investment, inflation, and the exchange rate.

The government has claimed that the economy is growing, but it is not bringing in enough revenue to meet the growing demands of its population. Meanwhile, the country is facing growing poverty, chronic power shortages, and a high inflation rate. The government has also incurred huge debts, which burden Pakistani households and make it harder to pay the bills. With a deteriorating economic situation, Pakistan could be heading toward a disaster.

The State Bank of Pakistan warns that the economy is recovering unevenly. However, the recent increase in private-sector credit indicates an expanding economy. Business is using credit to finance rising inventory costs fueled by high inflation. The State Bank of Pakistan predicts that the economy will grow slightly more than two percent in the current fiscal year.

Another factor affecting economic growth is the excessive money supply. In the short run, excessive money supply leads to higher inflation. The inflated money supply in Pakistan is a significant contributor to high inflation.

Pakistan

Bureau Of Statistics

Pakistan's inflation rate has reached a 47-year high. According to economist Khaqan Hassan Najeeb, who previously served as the government's Ministry of Finance adviser, the Consumer Price Index jumped 2.4% in August from the previous month. In the rural sector, the increase was even higher at 14.6%.

This rate is the result of rising prices of essential goods and services. The government has set an inflation target of 11.5% for the current fiscal year. During the outgoing week, prices of 31 essential goods jumped. In contrast, the prices of 17 items remained unchanged. The increase in the cost of essentials indicates that people face a difficult financial situation.

Several factors contributed to the rise in inflation in August. Flooding ravaged the country's agriculture and crops, raising prices for vegetables and other items. Global oil prices dropped by almost a third since June, but this did not result in a decrease in inflation. The government also extended electricity relief for two weeks. It is expected to affect the country's CPI data positively.

The consumer price index, which tracks prices of goods and services, increased to an annual rate of 24.9% in July, which is higher than the 21% that the Ministry of Finance had projected. The rupee's slide has contributed to the high inflation rate, as the rupee dropped to a record low of Rs239 to the dollar.

Inflation

Rises From 23.2% in September 2022

The Consumer Price Index (CPI) based inflation rate in Pakistan has increased to its highest level in 49 years. Still, it fell to 23.2% in September on a year-on-year basis, according to the Pakistan Bureau of Statistics. This decrease resulted from recent floods, lower international prices, and government economic policies. The September 2022 inflation rate was 21.2 percent in urban areas and 26.1 percent in rural areas.

The PBS's chief statistician has confirmed the reduction in electricity charges but says the fuel adjustment charges have only been deferred. Meanwhile, core inflation has risen to 14.4% in urban areas and 17.6% in rural areas. The high inflation rate could continue to grow for some time, however, as underlying pressures may continue to push prices up. The government has pledged to keep accurate interest rates positive, but the central bank has said it is unwilling to risk a recession in pursuit of a positive real interest rate.

Rural inflation has increased faster than in urban areas. The CPI in rural areas increased from 8.8% in September 2021 to 26.1% in September 2022, compared with a slight 0.7 percent rise in the previous month. The increase is not surprising, given that the rural population is growing faster than the cities and towns. Despite the sluggish economy, the country continues to show signs of improvement. Although inflation is still a concern, the government is doing its best to lower it.

Comments

Post a Comment